Wealth Management

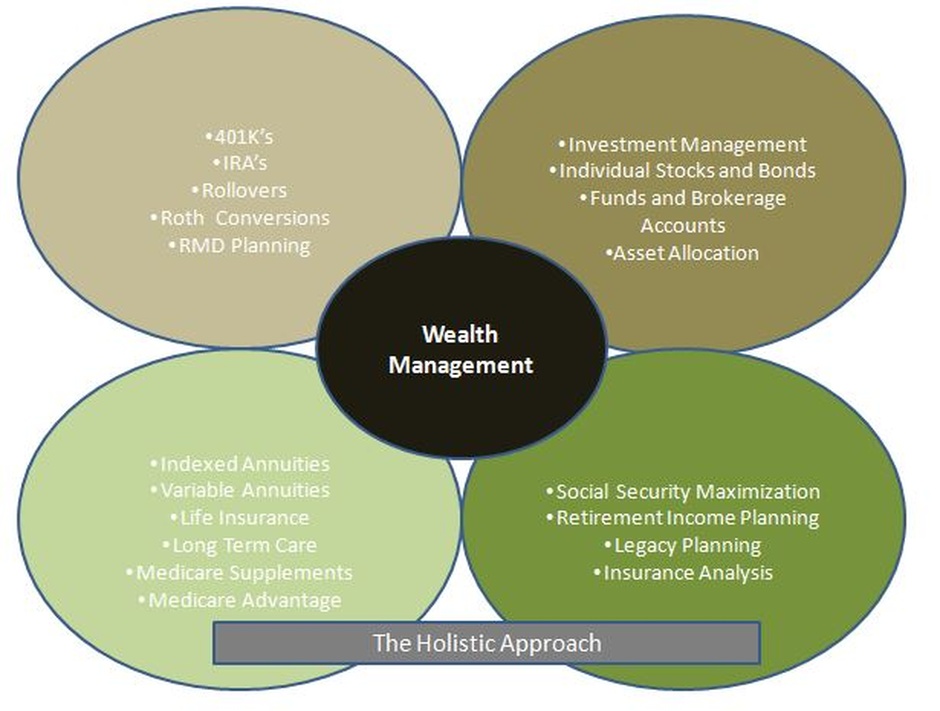

We use a holistic approach in analyzing all aspects of a person's financial life. These areas include investment strategies, insurance, security planning, budgeting, and tax savings.

Details about the planful approach are available in the book Retirement Income: An Owner’s Manual. Jon is proud to have written the introduction for his colleague, Nick Stovall. If you wish to learn more, give us a call or fill out our online form to request a copy.

Start Working on Your Plan

During your working years, your money has been focused on growth-only accounts. You might be very good at picking stocks and growing your money, but retiring means exiting the accumulation stage and entering the preservation and distribution stage. This means growth with protection.

If you do not plan properly, here some problems that you might encounter:

- Risk of Losing Money Due to Cost of Long-Term Care

- Out-of-Pocket Expenses Due to Health Insurance

- Longevity Risks of Outliving Your Money

- Inflation

- Overspending Due to Lack of an Income Plan

It is important to know exactly what’s coming in and what’s going out. You should determine where you are with regard to the plans and goals you want to achieve in retirement.

When creating a wealth management plan, consider your legacy and the question of what you want to leave behind. We also encourage you to apply tax strategies.